PVA Finance Calculator Present Value of Annuity (PVA) finance calculators are powerful tools used to determine the current worth of a series of future payments, given a specified discount rate or rate of return. Understanding PVA is crucial for making informed financial decisions, particularly when dealing with investments, loans, and retirement planning. These calculators simplify the complex mathematics involved, providing users with accurate and readily available results. The core concept behind PVA is the time value of money. Money available today is worth more than the same amount in the future due to its potential earning capacity. A PVA calculator factors this into its calculation, discounting each future payment back to its present-day value. This discounting process reflects the opportunity cost of receiving money later rather than sooner. Several factors influence the outcome of a PVA calculation. The most important are: * **Payment Amount:** The size of each individual payment in the annuity stream. Larger payments naturally result in a higher PVA. * **Interest Rate (Discount Rate):** This represents the rate of return you could earn on your money if you had it today. A higher interest rate leads to a lower PVA, as future payments are discounted more heavily. This reflects the increased opportunity cost. * **Number of Periods:** The length of time over which the annuity payments will be received. The longer the payment stream, the higher the PVA, all other factors being equal. * **Payment Timing:** PVA calculators distinguish between ordinary annuities (payments made at the end of each period) and annuities due (payments made at the beginning of each period). Annuities due will always have a higher PVA because the payments are received sooner. Using a PVA finance calculator is straightforward. Typically, the user inputs the payment amount, interest rate, number of periods, and specifies whether it’s an ordinary annuity or an annuity due. The calculator then performs the necessary calculations and displays the PVA. The applications of PVA calculators are wide-ranging. They are invaluable for: * **Investment Analysis:** Comparing the present value of future investment returns to the initial investment cost to determine if an investment is worthwhile. * **Loan Evaluation:** Calculating the present value of loan payments to understand the true cost of borrowing. * **Retirement Planning:** Estimating the present value of future retirement income streams to determine if sufficient savings are in place. * **Real Estate:** Determining the present value of rental income or mortgage payments. * **Settlements and Lawsuits:** Calculating the present value of structured settlements. While PVA calculators provide accurate results based on the input data, it’s important to remember that they are only as good as the assumptions used. The accuracy of the discount rate is crucial. It should reflect the true opportunity cost of capital and the risks associated with the investment or financial instrument being analyzed. Also, PVA calculations assume a constant discount rate over the entire period, which may not always be the case in reality. In conclusion, PVA finance calculators are essential tools for anyone needing to evaluate the present worth of future payments. By understanding the underlying principles and using these calculators carefully, individuals and businesses can make more informed and profitable financial decisions.

544×490 present annuity pva calculator from getcalc.com

544×490 present annuity pva calculator from getcalc.com

1024×768 time money powerpoint from www.slideserve.com

1024×768 time money powerpoint from www.slideserve.com

585×376 present annuity formula calculator excel template from www.educba.com

585×376 present annuity formula calculator excel template from www.educba.com

1024×526 present annuity due formula calculator excel template from www.educba.com

1024×526 present annuity due formula calculator excel template from www.educba.com

324×324 present calculator from www.calculatorsoup.com

324×324 present calculator from www.calculatorsoup.com

0 x 0 pvaf present annuity factor calculator ankit goyal from www.youtube.com

0 x 0 pvaf present annuity factor calculator ankit goyal from www.youtube.com

1024×768 time money chapter powerpoint from www.slideserve.com

1024×768 time money chapter powerpoint from www.slideserve.com

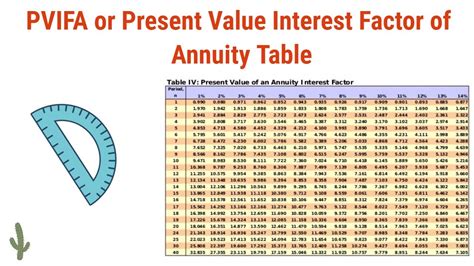

0 x 0 pvifa present interest factor annuity table from www.youtube.com

0 x 0 pvifa present interest factor annuity table from www.youtube.com

545×489 future annuity fva calculator from getcalc.com

545×489 future annuity fva calculator from getcalc.com

444×107 pvoa recording transaction amortizing discount from www.accountingcoach.com

444×107 pvoa recording transaction amortizing discount from www.accountingcoach.com

482×40 accounting intermediate accounting ii formulas studycom from study.com

482×40 accounting intermediate accounting ii formulas studycom from study.com

0 x 0 financial calculator part basic pv fv youtube from www.youtube.com

0 x 0 financial calculator part basic pv fv youtube from www.youtube.com